Steering a New Course on Foreign Policy

As election season approaches, and global crises in Greece and elsewhere intensify, U.S. foreign policy is in a state of drift that puts the United States at the risk of falling behind its rivals, says Eurasia Group President Ian Bremmer.

June 29, 2015 11:01 am (EST)

- Interview

- To help readers better understand the nuances of foreign policy, CFR staff writers and Consulting Editor Bernard Gwertzman conduct in-depth interviews with a wide range of international experts, as well as newsmakers.

As the United States enters election season, presidential hopefuls are formulating their positions on global crises ranging from Russian revanchism to rising tensions in the South China Sea. In Superpower: Three Choices for America’s Role in the World, Eurasia Group President Ian Bremmer argues that voters must choose the path forward, whether towards a United States that takes a more expansive role in the world, or one that focuses on rebuilding at home. U.S. foreign policy is currently in a state of drift, Bremmer says, and the United States is at risk of falling behind its rivals. "If there is one country in the world today that has a global strategy, it’s not the United States—it’s China," he says.

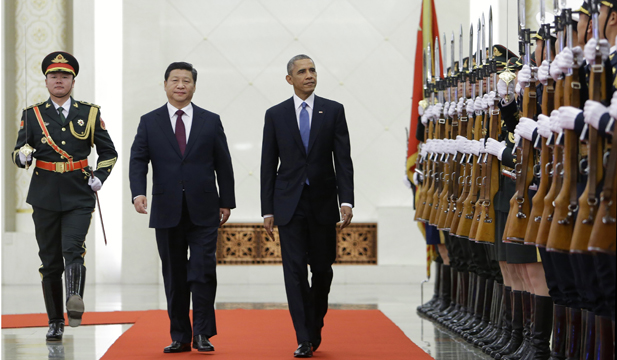

China’s President Xi Jinping walks next to U.S. President Barack Obama during a November 2014 welcoming ceremony in Beijing.(Photo: Jason Lee/Reuters)

China’s President Xi Jinping walks next to U.S. President Barack Obama during a November 2014 welcoming ceremony in Beijing.(Photo: Jason Lee/Reuters)Eurasia Group identified political dysfunction in Europe as its leading global risk in 2015. The Greek debt crisis has deteriorated rapidly in recent days, but even if a deal is reached in the short term, will the European Union be any closer to addressing its deeper structural issues?

More on:

Absolutely not. Everything we were concerned about at the beginning of the year—rising anti-Europe sentiment, divisions between EU governments, and the external threat from Russia—continues to be the case. A lot of that has to do with the internal European relationships—the very fact that a country as small as Greece could have caused this much dysfunction, and it still isn’t resolved.

Prime Minister Alexis Tsipras’ decision this weekend to call for a referendum and institute capital controls shows how desperate the situation has become. I believe that the Greeks will ultimately vote for the deal over Syriza’s "no" campaign, especially since the harrowing week ahead will give them a glimpse of what life will be like outside the EU. The question becomes what happens the day after—Tsipras has said that he will implement the will of the Greek people no matter what they decide, but it is hard to see his government withstanding such a public denouncement of their negotiating strategy. Syriza would also have to deal with the fallout of a "yes" vote that will lead to defections from their radical members who refuse to cooperate with creditors under any circumstance. Further complicating matters is that Syriza still has a sizeable lead in opinion polls, so another round of elections may actually strengthen its numbers in parliament, placing Brussels in a bind. Long story short, this saga will continue for some time. Even if the Greeks vote "no" for the deal, the EU will try to drag Grexit out as long as it can in the hopes that Tsipras’ government falls apart.

And even though I do think that both sides are heading for a last-minute deal, that would still not be a permanent fix. From the perspective of the troika [the European Commission, the European Central Bank (ECB), and the International Monetary Fund (IMF)], the question will continue to be, "Are the Greeks implementing enough reforms?" In other words, more trying to squeeze blood from a stone. This latest gambit by Tsipras may soften their stance a little, but not enough for them to effectively address the underlying problems of the Greek economy.

"What is needed in Europe is strength, leadership, and a desire to build and strengthen European institutions. Currently the opposite is happening."

Across Europe, we still see growing support for euroskeptic political parties. We see this in Spain, in Denmark, in France, and we even see it in Germany. What is needed in Europe is strength, leadership, and a desire to build and strengthen European institutions. Currently the opposite is happening, making it very hard, even though economic indicators are improving, to be positive about Europe’s trajectory.

More on:

On top of that, the big geopolitical rifts are not getting resolved. There are a record number of refugees emanating from the Middle East and sub-Saharan Africa, as well as the escalating U.S.-Russia crisis and, of course, the invasion of Ukraine. All of this affects the Europeans vastly more than it effects the United States or China, and continues to be a downward drag on their economies.

What role can the United States play in Europe when the region’s leaders—particularly Germany and France—can’t agree on the way forward, and another major power, the UK, is flirting with leaving the EU altogether?

The transatlantic relationship, which was the bedrock of the postwar order, has dramatically weakened. At this month’s G7 summit, for instance, it was hard for the Americans to convince the Europeans just to maintain the present level of sanctions against Russia for six more months. That’s despite consistent Russian escalation.

Europeans are hesitant to commit to NATO, despite the fact that many countries, such as the Baltic states and Poland, are more concerned about their security than at any point since the Soviet Union collapsed. The Americans want to put heavy weaponry and rapid reaction capabilities in the Baltics, but lack consistent support from the Europeans. On Ukraine, however, the Germans and the French, not the Americans, have been leading the negotiations.

On the Greece crisis, the Americans have made some calls. Treasury Secretary Jacob Lew told the Germans a few months ago, ’Hey, we expect more from you,’ and he told the Greeks the same thing a few days ago. But aside from peanut gallery kibitzing, there has been very little direct American involvement in trying to push for a stronger Europe.

And the Obama administration is about to conclude the Trans-Pacific Partnership (TPP), which I’m a very big fan of. It covers 40 percent of global GDP. Once it gets done, now that we’ve seen support from the Senate, it will be the most significant foreign policy accomplishment of President Obama’s two terms. It will be more significant than rapprochement with Cuba, and even more significant than an Iran nuclear deal. But a European trade deal, the Transatlantic Trade and Investment Partnership (TTIP), is getting nowhere right now. TTIP is precisely the kind of thing that would strengthen U.S.-Europe relations. We’re very far from that.

In Superpower you argue for what you call "Independent America," which means focusing on reinvesting in the United States domestically. How do these trade deals, which critics say lower wages and erode the manufacturing base, fit into that?

It is certainly true that TPP is going to have some negative effects on U.S. labor, specifically in manufacturing. A lot of U.S. multinational corporations are going to be very happy with lower tariffs, and will import more into the U.S. market. As a result, the U.S. economy will grow, but some middle class sectors will get hit. I think that will get balanced by lower agricultural tariffs, with U.S. farming actually doing quite well.

The erosion of U.S. labor is currently more about automation than about the Chinese taking American jobs. Even as the United States is seeing massive "insourcing" as lower energy prices reduce the cost of production, manufacturing employment is still not picking up. That has less to do with globalization and trade, and much more to do with technology.

"If there is one country in the world today that has a global strategy, it’s not the United States—it’s China."

If there is one country in the world today that has a global strategy, it’s not the United States—it’s China. China is expanding its international trade, creating new financial institutions, and spending well over a trillion dollars to back it up, via the Asian Infrastructure Investment Bank (AIIB), the Silk Road initiatives, and the BRICs New Development Bank. The Chinese are trying to develop state-led trade and investment standards that will directly undermine those supported by the United States. Whatever you think about the TPP from an economics perspective, an abdication from the United States would be a bad thing. Trade architecture is one of the most important pieces of American long-term strategy, and I think it’s important to get it concluded.

To the extent that the TPP has a geopolitical dimension, isn’t China offering much more to its neighbors than the United States is?

Yes, the Chinese are writing checks. But Chinese conditionality is less popular. Chinese investments are less stable, they often lack rule of law, and it is certainly true that the quality of Chinese management and the quality of Chinese products tends to be lower. So many countries are reluctant to switch over to the Chinese from the United States. For instance, even though the Saudis are very upset with the United States right now, they aren’t suddenly turning to China for all of their arms purchases.

Still, for every person who thinks there are too many strings attached to the checks China is writing, there are ten more who really want those checks. The Chinese have an industrial policy and are actively promoting their state corporations and using state capital to finance their largest firms, or "national champions." That’s something the Americans don’t do, and it’s a disadvantage.

Speaking of Saudi Arabia, what do low oil prices, combined with the prospects of an Iran nuclear deal and the lifting of Iranian sanctions, mean for the U.S. position in the Middle East?

The U.S. position in the Middle East is clearly already very different than it was. The wars in Iraq and Afghanistan are partly responsible, but a major factor is the U.S. energy revolution. The United States no longer relies on the Gulf Arab producers the way it used to. As you mentioned, oil prices are down almost 50 percent from this time last year.

Americans will continue to drive efficiency and improve productivity in fracking, and nonconventional sources are expanding in the UK, Eastern Europe, South America, and China. Solar and battery technologies are expanding, and the likely Iran deal would lead to one million additional barrels of oil on the market every day.

Putting all of these things together, Saudi Arabia is in very serious trouble. It is not a diversified economy—just 20 percent of women work in Saudi Arabia, the lowest in the Middle East. It’s even lower than Yemen, which is astonishing given that Yemen doesn’t really have an economy. The real question is what they are going to do about it, but the steps they’ve taken thus far really do not give a lot of hope for their trajectory.

You argue that the American people must decide what kind of foreign policy they want. There has been a lot of criticism of the secrecy surrounding trade negotiations, as well as broader concerns over secrecy and executive power. Does that pose a problem for democratic accountability and the ability of citizens to choose their preferred foreign policy?

I’m less worried, partly because I think secrecy is increasingly going away—not because American policymakers want it to, but because technology makes secrecy difficult. Much of the TPP was made public by organizations releasing the secret files. We just saw Wikileaks perform another massive dump of some 500,000 classified documents into the public domain. We’re going to see much more of this.

But it’s going to be more damaging for other countries. The United States ultimately has a resilient set of political institutions, unlike many authoritarian states which require secrecy to function. The Americans don’t require secrecy to function, they just like it. Will the United States be embarrassed by some of the activities that come to light? Yes it will. But this will be a much bigger problem for China and Russia.

Because millennials have grown up with Facebook, social networking, and smartphones, they are a generation used to having all of their information public. They’re not going to be very sympathetic to U.S. government arguments that there should be an awful lot of secrecy. Several weeks ago, Congress passed the USA Freedom Act which, for the first time since 9/11, actually put some restraints on what the NSA can collect. It’s a relatively modest move, but in the context of where the country was after 9/11, it’s actually quite a sea change. I think we’re going to see a lot more of that as American demographics change.

Online Store

Online Store